The shooting star best candlestick pattern is a bearish reversal candlestick pattern that typically occurs at the end of find an uptrend. It signals a potential reversal in price direction from upward to downward. The shooting star pattern has the following characteristics:

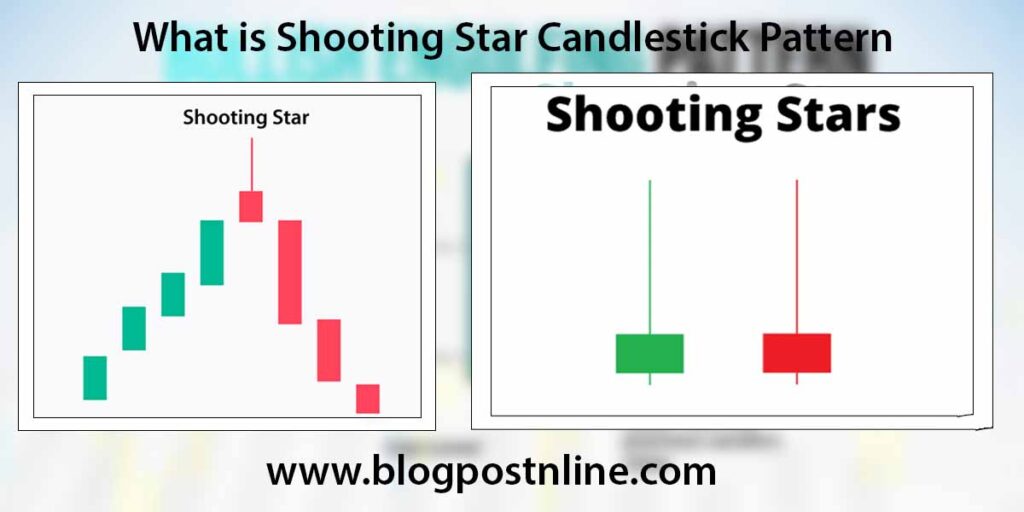

- Small Real Body: The candlestick has a small real body, which can be either bullish (white or green) or bearish (black or red). This small body represents the narrow range between the opening and closing prices andtechnical analysis in Tradeview Website.

- Long Upper Shadow: There is a long upper shadow, usually at least twice the length of the real body. This indicates that the price rallied significantly during the trading session but then gave up most of the gains, closing near the opening price.

- Little or No Lower Shadow: The lower shadow is very small or non-existent, showing that the bears managed to push the price back down to the opening level or close to it.

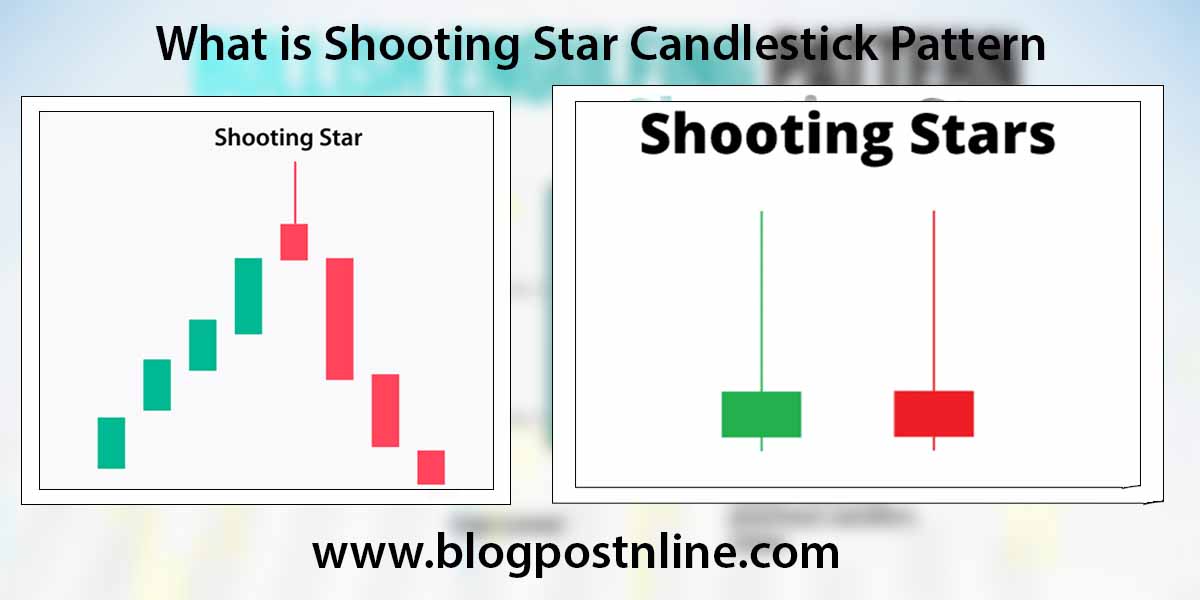

Example of a Shooting Star Candlestick Pattern

Here is an example of how a shooting star candlestick looks:

Interpretation

- Market Sentiment: The shooting star pattern suggests that the bulls initially drove prices higher, but by the end of the trading session, the bears took control and pushed the price back down near the opening level. This shift in sentiment from bullish to bearish indicates a potential reversal.

- Confirmation: While the shooting star itself is a bearish indicator, traders typically wait for confirmation before taking action. Confirmation comes in the form of a subsequent candlestick with a lower closing price, which supports the reversal signal.

A Complete Gudie All Candlestick Pattern Look Here.

Trading Strategy

- Entry Point: Traders might consider entering a short position if a shooting star is followed by a bearish candlestick.

- Stop Loss: A stop-loss order is often placed above the high of the shooting star to manage risk, as a move above this high would invalidate the bearish reversal signal.

- Take Profit: Profit targets can be set at key support levels or using other technical analysis tools like Fibonacci retracement levels.

In this ASCII representation, you can see a long upper shadow with a small real body near the bottom, typical of a shooting star.

Conclusion

The shooting star is a useful pattern for identifying potential reversals in an uptrend, but like all technical indicators, it should be used in conjunction with other analysis tools and market factors to make informed trading decisions.