A bullish engulfing candle is a powerful pattern used by traders in the forex market to identify potential reversals in the price direction of a currency pair.

This pattern consists of two candles and typically occurs at the end of a downtrend, signaling a potential bullish reversal. Here is a high-quality breakdown of the bullish engulfing candle pattern:

Characteristics of a Bullish Engulfing Candle

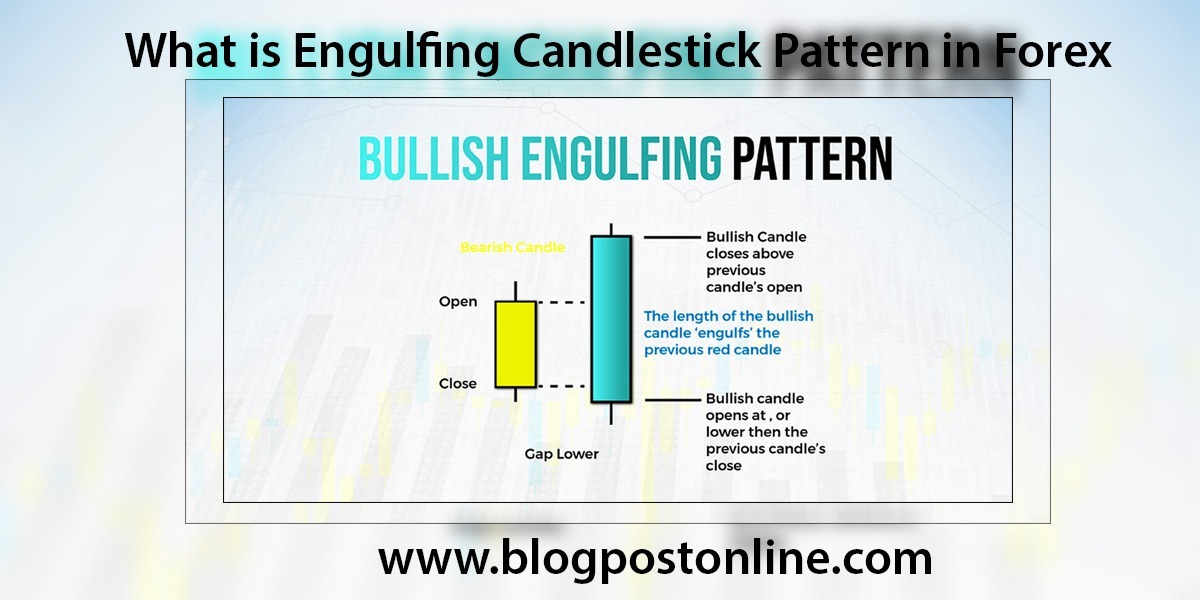

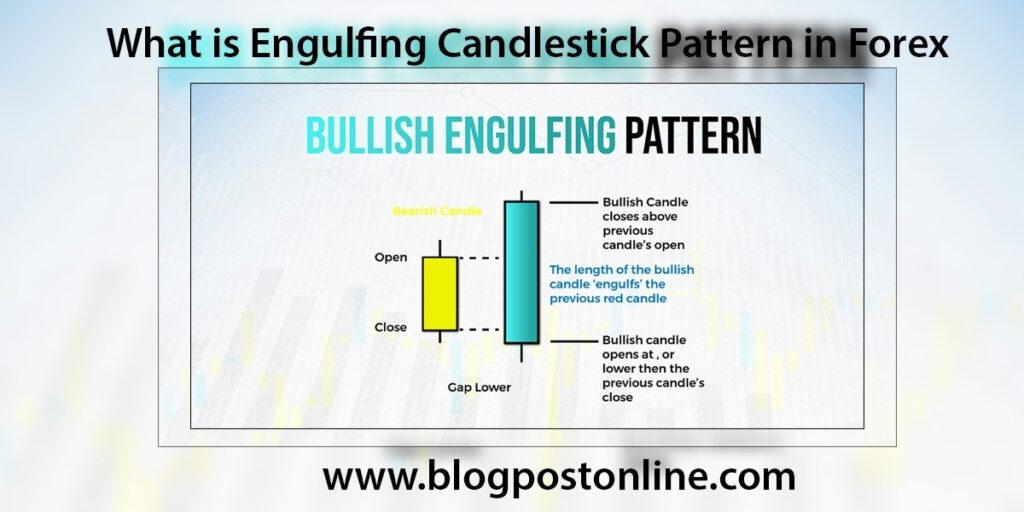

- Two-Candle Pattern: The bullish engulfing pattern comprises two candles:

- The first candle is bearish (i.e., the closing price is lower than the opening price).

- The second candle is bullish (i.e., the closing price is higher than the opening price).

- Engulfing Nature: The body of the second bullish candle completely engulfs the body of the first bearish candle. This means the second candle’s open price is lower and the close price is higher than the respective prices of the first candle.

- Downtrend Context: This pattern is significant when it appears after a sustained downtrend. It suggests that the sellers have lost momentum and buyers are gaining control, potentially leading to a price reversal.

Formation and Implications

- First Candle: The market is in a downtrend, and the first candle continues this trend by closing lower than it opened, reinforcing bearish sentiment.

- Second Candle: The market opens lower than the previous candle’s close, showing initial bearish continuation. However, strong buying pressure pushes the price higher, resulting in a close above the previous candle’s open, indicating a bullish reversal.

- Market Psychology: The shift from bearish to bullish sentiment is marked by the engulfing candle. Traders interpret this as a sign that buyers are overwhelming sellers, often leading to further price increases.

Identifying a Bullish Engulfing Pattern

- Downtrend Confirmation: Ensure that the pattern appears after a clear downtrend.

- Candle Size and Body: The second candle must completely cover the body of the first candle, not necessarily the wicks (shadows).

- Volume: Higher trading volume on the second candle adds confirmation, indicating strong buying interest.

Trading the Bullish Engulfing Pattern

- Entry Point: Traders often enter a long (buy) position at the close of the second candle or the opening of the next candle.

- Stop Loss: Place a stop-loss order below the low of the engulfing pattern to manage risk.

- Profit Targets: Set profit targets based on key resistance levels or use trailing stops to lock in gains as the price moves in favor. and best tradeview website in technical analysis.

Example of a Bullish Engulfing Pattern

Consider a scenario where EUR/USD is in a downtrend. The pair prints a small bearish candle, followed by a larger bullish candle that engulfs the entire body of the bearish candle. This indicates that buyers have taken control, and traders might look to enter long positions, anticipating a reversal and upward movement in price.

Conclusion

The bullish engulfing candle is a robust reversal pattern that can provide valuable insights into market sentiment and potential trend changes. Traders use this pattern, along with other technical indicators and analysis, to make informed trading decisions in the forex market. By understanding and identifying this pattern, traders can enhance their ability to spot profitable opportunities and manage risks effectively.