Trading the bullish engulfing candlestick pattern in Forex involves recognizing the pattern, confirming the signal, and executing the trade with proper risk management. Here’s a step-by-step guide:

Step 1: Identify the Bullish Engulfing Pattern

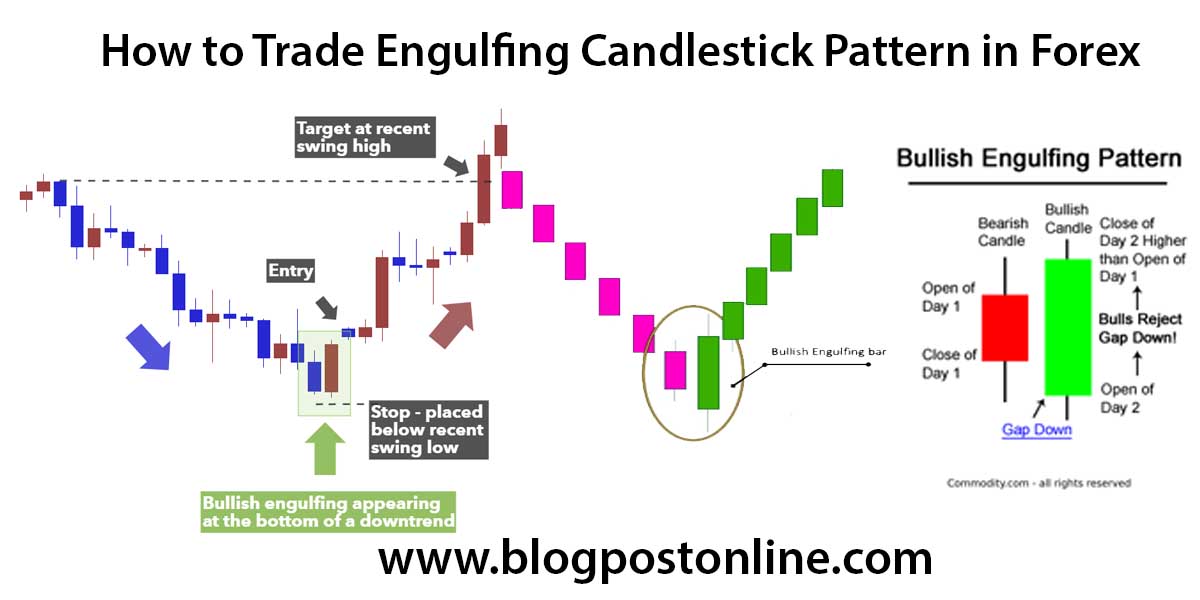

The bullish engulfing pattern consists of two candles:

- First Candle (Bearish): A smaller bearish candle indicating the continuation of a downtrend.

- Second Candle (Bullish): A larger bullish candle that completely engulfs the first candle, indicating a potential reversal from bearish to bullish.

Step 2: Confirm the Pattern

To increase the probability of a successful trade, look for additional confirmation signals:

- Volume Increaser : Higher best trading volume increase during the best formation of the bullish engulfing candlestick pattern suggests stronger buying side interested Buyer.

- Support Level: The pattern forming near a key support level adds strength to the reversal signal.

- Technical Indicators: Indicators like RSI (Relative Strength Index) showing oversold conditions or a MACD (Moving Average Convergence Divergence) crossover can confirm the reversal.

Step 3: Entry Point

- Conservative Entry: Enter the trade at the opening price of the candle following the bullish engulfing pattern.

- Aggressive Entry: Enter the trade immediately after the bullish engulfing candle closes.

Step 4: Stop Loss Placement

To manage risk, place a stop loss at a strategic level:

- Below the Low: Place the stop loss just below the low of the bullish engulfing candle.

- Support Level: Alternatively, place it below a significant support level near the pattern.

Step 5: Take Profit Targets

Set take profit levels based on your trading strategy:

- Resistance Levels: Identify and set take profit targets at key resistance levels.

- Risk-Reward Ratio: Ensure a favorable risk-reward ratio, such as 1:2 or 1:3.

Step 6: Monitor the Trade

Keep an eye on the trade and be ready to adjust your stop loss to lock in profits as the price moves in your favor. You can use a trailing stop to follow the price movement.

Example Scenario

- Identify: Spot a bullish engulfing pattern at a significant support level.

- Confirm: Check for an increase in volume and an oversold RSI.

- Enter: Enter the trade at the opening of the next candle.

- Stop Loss: Place the stop loss below the low of the engulfing candle.

- Take Profit: Set the take profit level at a nearby resistance point.

Practical Tips

- Timeframes: Bullish engulfing patterns are more reliable on higher timeframes (e.g., daily or weekly charts).

- Market Context: Consider the overall market trend. Bullish engulfing patterns are more effective when they occur at the end of a downtrend.

- Backtesting: Backtest the pattern on historical data to understand its performance and refine your strategy.

Example of a Bullish Engulfing Trade

Let’s consider an example on a daily EUR/USD chart:

- Identification: On May 1st, a bullish engulfing pattern forms at 1.2000, a significant support level.

- Confirmation: Volume spikes and RSI is below 30, indicating oversold conditions.

- Entry: Enter at 1.2020, the opening of the next day.

- Stop Loss: Place a stop loss at 1.1950, below the low of the engulfing candle.

- Take Profit: Set the take profit at 1.2150, a resistance level, achieving a risk-reward ratio of approximately 1:2.

By following these steps and practicing proper risk management, you can effectively trade the bullish engulfing candlestick pattern in Forex.

how to trade bullish engulfing candlestick pattern in forex trading high quality content

ChatGPT

Trading the bullish engulfing candlestick pattern in Forex trading requires a detailed understanding of market dynamics, pattern recognition, confirmation techniques, and disciplined risk management. Below is a comprehensive guide to trading this pattern effectively:

Understanding the Bullish Engulfing Pattern

The bullish engulfing pattern is a strong reversal signal that typically appears at the end of a downtrend. It consists of two candles:

- First Candle (Bearish): A smaller red candle indicating continued selling pressure.

- Second Candle (Bullish): A larger green candle that completely engulfs the body of the first candle, indicating a shift from selling to buying dominance.

Characteristics of a Bullish Engulfing Pattern

- Size Matters: The bullish candle should engulf the bearish candle entirely, not just in terms of the body but also ideally in terms of shadows.

- Volume Consideration: An increase in volume during the formation of the bullish candle can add weight to the pattern’s reliability.

- Market Context: The pattern should appear after a clear downtrend to indicate a potential reversal.

Step-by-Step Guide to Trading the Bullish Engulfing Pattern

Step 1: Identify the Pattern

- Scan for Patterns: Use charting software or manual analysis to scan for potential bullish engulfing patterns on your preferred timeframes (higher timeframes like daily or weekly are more reliable).

- Confirm the Downtrend: Ensure that the pattern appears at the end of a downtrend by analyzing previous price action.

Step 2: Confirm the Signal

- Support Levels: Check if the pattern forms near a significant support level. The confluence of support and a bullish engulfing pattern strengthens the reversal signal.

- Technical Indicators:

- RSI (Relative Strength Index): An RSI below 30 indicates oversold conditions, supporting the bullish reversal.

- MACD (Moving Average Convergence Divergence): Look for a bullish crossover or divergence.

- Volume Analysis: A noticeable increase in volume on the bullish candle suggests strong buying interest.

Step 3: Plan the Trade

- Entry Point:

- Conservative Entry: Enter the trade at the opening price of the next candle after the bullish engulfing pattern is confirmed.

- Aggressive Entry: Enter immediately after the bullish engulfing candle closes if additional confirmations are present.

- Stop Loss Placement:

- Below the Low: Place the stop loss just below the low of the bullish engulfing candle to protect against false breakouts.

- Support Level: Alternatively, place it below a nearby significant support level for added safety.

- Take Profit Targets:

- Resistance Levels: Identify and set take profit targets at key resistance levels to maximize gains.

- Risk-Reward Ratio: Ensure a favorable risk-reward ratio, ideally 1:2 or better.

- Best Technical analysis Chart Pattern read Website look here visit now.

Step 4: Execute the Trade

- Position Sizing: Use proper position sizing techniques to manage risk effectively. Never risk managment more than 1-2% of your best trading setup and capital on the single trade.

- Enter the Trade: Execute the trade according to your entry point plan.

Step 5: Monitor and Adjust

- Trail Stop Loss: As the trade moves in your favor, adjust your stop loss to lock in profits. Use the stoploss trailing stop to the follow the price action movement.

- Partial Profits: Consider taking partial profits at intermediate resistance levels to secure some gains while allowing the rest of the position to run.

Practical Example

Let’s walk through a practical example on a daily EUR/USD chart:

- Identify: Spot a bullish engulfing pattern at 1.2000, a significant support level.

- Confirm: Volume spikes on the bullish candle, and the RSI is below 30.

- Plan:

- Entry: Plan to enter at 1.2020, the opening of the next candle.

- Stop Loss: Place the stop loss at 1.1950, below the engulfing candle’s low.

- Take Profit: Set the take profit at 1.2150, a resistance level.

- Execute: Enter the trade at 1.2020.

- Monitor: Adjust the stop loss to 1.2050 as the price moves in favor and consider taking partial profits at 1.2100.

Additional Tips

- Backtesting: Backtest the pattern on historical data to understand its success rate and refine your strategy.

- Emotional Discipline: Stick to the your best trading plan and the avoid emotional trading decisions. Own your Consistency is best key.

- Educational Resources: Continuously educate yourself through books, courses, and trading communities to enhance your trading skills.

By following this structured approach, you can effectively trade the bullish engulfing candlestick pattern in Forex, enhancing your chances of capturing profitable reversals while managing risks prudently.