Technical analysis in the forex market involves using historical price data, volume, and other market statistics to forecast future price movements. Unlike fundamental analysis,

which examines economic indicators and financial statements, technical analysis focuses on price action and patterns.

Here are the key components and tools used in technical analysis for trading the forex market:

The concept of technical analysis in the forex market involves studying historical price movements to forecast future price changes. It is a method used by traders to analyze price charts, identify trading opportunities, and determine entry and exit points for positions.

Technical analysis is particularly well-suited for the forex market due to its liquidity, sensitivity to trends, and the variety of technical tools available for analysis.

Traders can use techniques like moving averages, Bollinger Bands, Fibonacci retracements, and various oscillators and momentum indicators to make informed trading decisions.

Key Components

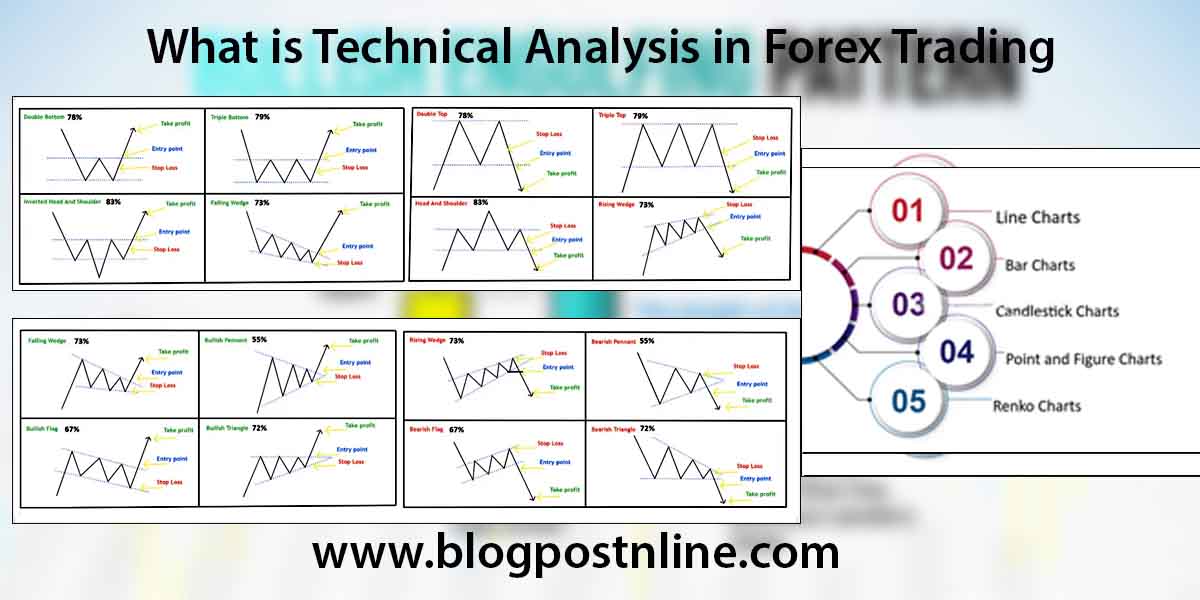

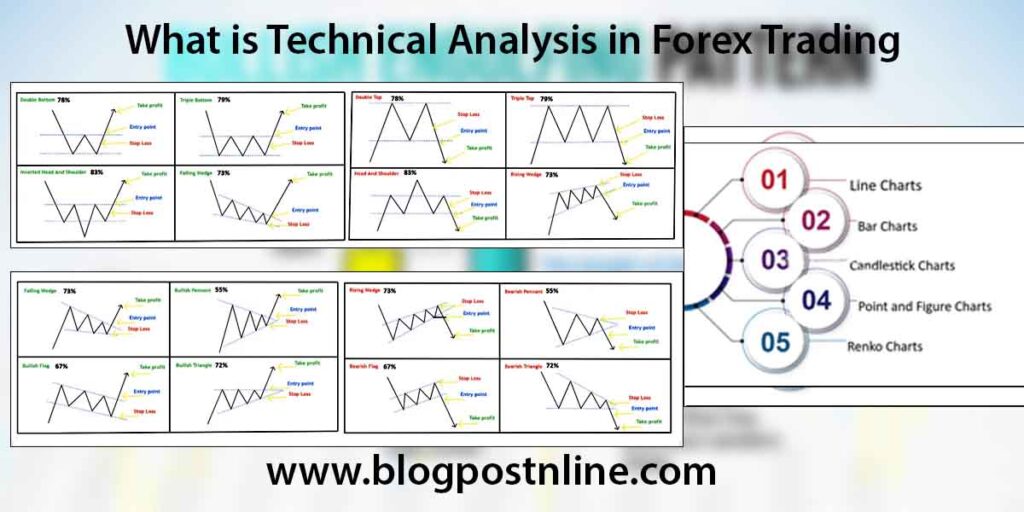

- Price Charts: The foundation of technical analysis forex trading strategies, price charts display the historical price movements of currency pairs. Common types of chart patterns include line chart patterns, bar charts, and candlestick chart patterns.

- Time Frames: Technical analysis can be applied to various time frames, from minute-by-minute charts for short-term trading to daily, weekly, or monthly charts for long-term analysis scalping trading strategy .

- Trends: Identifying trends (uptrend, downtrend, sideways) is crucial. An uptrend is characterized by higher highs and higher lows, a downtrend by lower highs and lower lows, price action strategy and a sideways trend by relatively stable prices forex day trading .

- Support and Resistance Levels: Support levels are where prices tend to stop falling and reverse upward, while resistance levels are where prices tend to stop rising and reverse downward. These levels are often used for setting entry and exit points price action trading .

- Indicators and Oscillators: These are mathematical calculations based on price, volume, or open interest. Popular indicators include Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, and Stochastic Oscillator and robot trading forex .

Common Tools and Techniques

- Moving Averages (MA):The forex trading course Used to smooth out price data and identify trends. Common mistks types are the best Simple Moving Average (SMA) and forex trading indicators best Exponential Moving Average (EMA).

- Relative Strength Index (RSI): An oscillator that measures the speed and change of price movements, typically used to identify overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages and is used to identify changes in the strength, direction, momentum, and duration of a trend.

- Bollinger Bands: Consist of a middle band (a moving average) and two outer bands set at a standard deviation away from the middle band. They are used to measure market volatility.

- Fibonacci Retracement Levels: Horizontal lines that indicate where support and resistance levels are likely to occur based on the Fibonacci sequence. They are used to identify potential reversal levels.

- Candlestick Patterns: Specific formations of candlesticks that predict future price movements. Examples include Doji, Hammer, Shooting Star, Engulfing patterns, and forex trading analysis in Tradeview system many others.

- Chart Patterns: Larger formations on charts that indicate potential future price movements, such as Head and Shoulders, Double Tops and Bottoms, Triangles, and Flags forex trading mentor.

Steps in Technical Analysis

- Analyze the Chart: Start with identifying the current trend and the overall market structure. Determine key support and resistance levels.

- Apply Indicators: Use one or more technical indicators to get additional confirmation of trends and potential reversal points.

- Identify Patterns: Look for specific candlestick and chart patterns that might suggest a continuation or reversal of the current trend.

- Develop a Trading Plan: Based on your analysis, create a plan that includes entry and exit points, stop-loss levels, and profit targets.

- Risk Management: Always apply proper risk management techniques to protect your capital. This includes setting stop-loss orders and limiting the size of positions based on your risk tolerance.

Conclusion

Technical analysis is a powerful tool for forex traders, helping them to make informed decisions based on historical price data and statistical indicators.

By combining various tools and techniques, traders can develop strategies to maximize their chances of success in the highly dynamic forex market. However,

it’s important to remember that no single method guarantees success, and technical analysis should be used in conjunction with other forms of analysis and risk management strategies.