What Is Bearish Candlestick Pattern and how to trade Bearish Engulfing Pattern technical analysis Complete Guide online free book What is Technical analysis.

How to trade Bearish Engulfing candlestick pattern complete guide

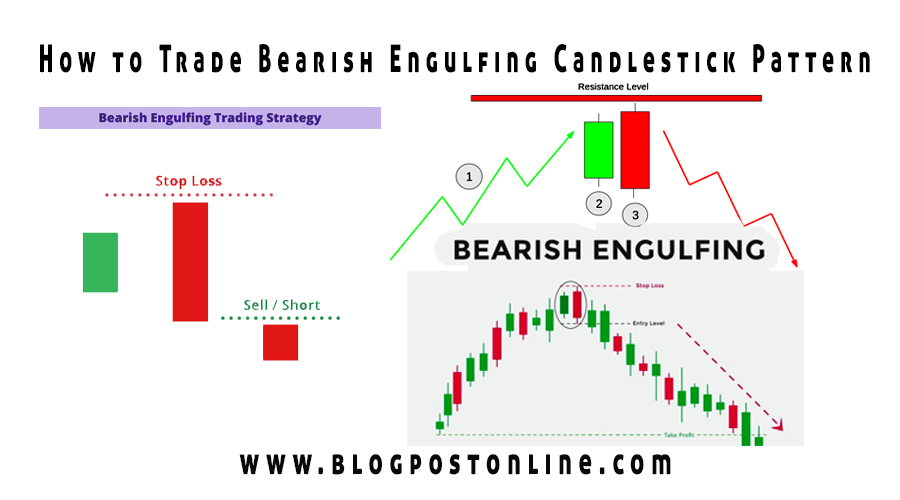

A bearish engulfing candlestick pattern is a significant technical indicator used in technical analysis to signal a potential reversal of an uptrend in a financial market.

This pattern typically consists of two candles and is considered bearish because it suggests that sellers are gaining control over the market and that a potential price decline may follow.

Here’s how to identify and trade the bearish engulfing pattern:

Identification of a Bearish Engulfing Pattern:

Uptrend: The bearish engulfing pattern is most meaningful when it occurs after a sustained uptrend in the price of an asset.

First Candle (Bullish): The first candlestick in the pattern is a bullish (green or white) candle, representing a day where the market was dominated by buyers. This candle ideally has a long body.

Second Candle (Bearish): The second candlestick is a bearish (red or black) candle that follows the first one. It should have a larger body than the first candle and completely “engulfing” or cover the entire range of the first candle, including both the body and the wicks/shadows.

Forex Trading Live Trade kaise kare

Trading the Bearish Engulfing Pattern:

The bearish engulfing pattern is considered a reversal signal, suggesting that the uptrend may be losing momentum, and a potential downtrend could follow.

Here’s how traders may approach it:

Confirmation: While the pattern itself is a strong bearish signal, it’s often a good practice to look for confirmation from other technical indicators or price action signals. This can help reduce false signals.

Stop-Loss and Entry Points: Consider placing a stop-loss order above the high of the second (bearish) candle to limit potential losses if the market doesn’t behave as expected. Entry can be near the open of the second candle or after it, depending on your risk tolerance.

What is Forex Trading and Technical analysis SMC?

Target Price: Determine a target price for your trade, which could be based on support levels, Fibonacci retracement levels, or other technical analysis tools. This helps you set a profit target.

Risk Management: It’s essential to manage your risk by setting an appropriate position size and using stop-loss orders to protect your capital.

Monitoring: Keep an eye on the price action after entering the trade. If the price continues to move in your favor, you may consider trailing your stop-loss to lock in profits as the downtrend develops.

Exit Strategy: When the price reaches your target or shows signs of reversing the bearish trend, consider exiting the trade to secure your gains.

Remember that no trading strategy is foolproof, and it’s crucial to combine the bearish engulfing pattern with other technical analysis tools and risk management techniques to make informed trading decisions. Additionally, practicing on a demo account or using paper trading can help you gain experience before risking real capital in the markets.

Trading bearish engulfing patterns using technical analysis involves identifying the pattern on a price chart and then making trading decisions based on its interpretation.

Here’s how you can trade bearish engulfing patterns:

Identify the Bearish Engulfing Pattern:

- Look for the a prevailing uptrending in the price charts.

- The bearish market engulfing Candlestick pattern consists of two candlestick:

- The first candlestick is a smaller bullish (green or white) candlestick.

- The second candlestick is a larger bearish (red or black) candlestick that completely engulfs the first candlestick.

Confirm the Pattern:

To increase the reliability of the bearish engulfing pattern, look for additional confirmation factors such as:

- Volume: Higher volume during the bearish engulfing pattern suggests greater selling pressure and increases the pattern’s reliability.

- Confluence with support/resistance levels, trendlines, or other technical indicators.

Set a Stop-Loss Order:

- Determine a point at which you will exit the trade if the market moves against you. This is your stop-loss level, and it should be placed above the high of the engulfing candlestick.

Set a Take-Profit Target:

- Decide where you want to take profits if the trade goes in your favor. This is your take-profit level, and it can be set at a previous support level, a moving average, or based on your risk-reward ratio.

Risk Management:

- Calculater your Price position size based on your risks tolerance. Typically, traders risk a small percentage of their trading capital on each trade.

Execute the Trade:

- Once you’ve identified the bearish engulfing pattern and confirmed it, place a sell order to go short in the market. This means you’re betting that the price will go down.

Monitor the Trade:

- Keep an eye on the trade and follow your trading plan.

- If the price starts moving in your favor, you may consider trailing your stop-loss to lock in profits or move your take-profit target lower.

Exit the Trade:

- Exit the trade when one of the following conditions is met:

- The price reaches your take-profit level.

- The price moves against you, and your stop-loss order is triggered.

- You see a reversal or conflicting signals that suggest it’s time to exit the trade.

Review and Learn:

- After the trade is closed, analyze it to learn from your experience. Evaluate what went well and what could be improved for future trades.

Remember that trading based solely on candlestick patterns, including the bearish engulfing pattern, carries risks. It’s essential to use proper risk management, consider additional technical and fundamental analysis, and have a trading plan in place to minimize losses and maximize your chances of success.

Additionally, backtesting and practicing on a demo account can help you gain confidence in your trading strategy.