What is Three White Soldiers Pattern in hindi and English. How to trade Three White Soldiers Pattern a traders Complete Guide with Technical Analysis Chart pattern full Information About Forex trading and Stock Trading Best Trading Statergy.

The “Three White Soldiers” is a candlestick pattern in Hindi mein that can be observed in both the forex market and the stock market. This pattern is generally considered a bullish reversal pattern and is used by traders and analysts to identify potential upward reversals in price trends and three white soldiers pattern target achievement Hindi Blog post and English Blog Post.

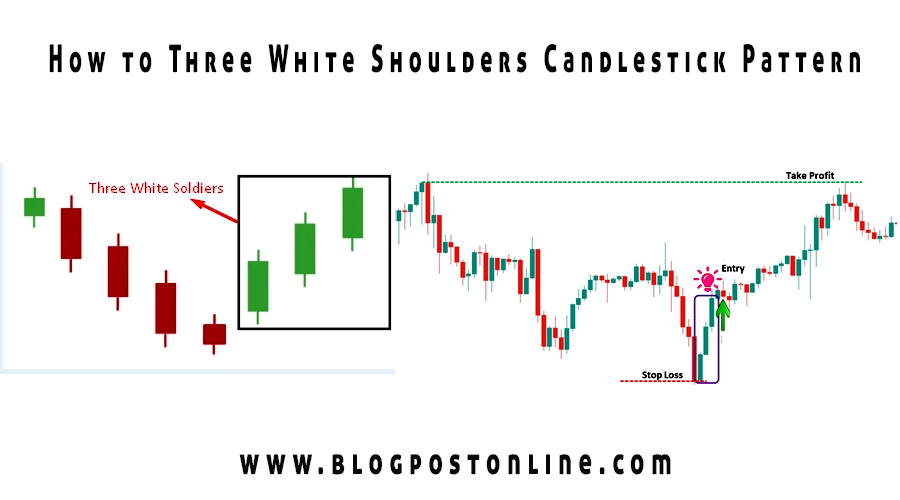

Here’s a breakdown of the pattern three white soldiers candlestick pattern in hindi:

Three Consecutive Bullish Candlesticks: The Three White Soldiers pattern consists of three consecutive bullish (green or white) candlesticks. Each candlesticks pattern should open higher than the previous day’s close and close day near it highs.

Absence of Significant Upper Shadows: Ideally, there should be little to no upper shadows (wicks) on these candlesticks, indicating strong buying pressure throughout the trading sessions.

Increasing Volume: Ideally, the volume should increase as the pattern forms, supporting the notion of strong buying interest.

When the Three White Soldiers pattern appears after a downtrend, it suggests that the bearish momentum may be weakening, and a potential trend reversal to the upside could be imminent. However, like all technical analysis patterns, it’s essential to consider other factors, such as support and resistance levels, trendlines, and overall market conditions, before making trading decisions.

Best Trading Inforamtion ang Best Trading Statergy Complete Guide

Traders often use confirmation signals or additional technical indicators to increase the reliability of this pattern. Common confirmation signals might include observing the Relative Strength Index (RSI) for overbought conditions or waiting for a break above a significant resistance level.

Keep in mind that no trading pattern is foolproof, and risk management is crucial when trading in the forex or stock markets. It’s also essential to stay updated with the latest market news and events, as sudden unexpected developments can influence market movements.

The “Three White Soldiers” is a bullish candlestick pattern that is commonly used in technical analysis to identify potential trend reversals or strong upward momentum in the forex and stock markets. This pattern consists of three consecutive bullish (upward) candles that have certain characteristics.

Here’s how to identify and trade the Three White Soldiers pattern:

Identifying the Three White Soldiers Pattern:

Candlestick Requirements:

- Each candle in the pattern should be a strong bullish candle with a relatively long body.

- The open of each candle should be within the previous candle’s body, and the close should be significantly higher than the previous candle’s close.

- There should be minimal or no upper shadows (wicks) on the candles, indicating strong buying pressure throughout the session.

Pattern Location:

- The Three White Soldiers pattern is more reliable when it appears after a downtrend or consolidation, signaling a potential reversal or continuation of an uptrend.

Trading the Three White Soldiers Pattern:

Once you’ve identified the Three White Soldiers pattern, you can consider potential trading strategies:

Entry Point:

- Enter a long (buy) position after the third bullish candle has closed.

- Some traders prefer to wait for a confirmation candle (a small bearish candle or doji) to appear after the third white soldier to confirm the bullish momentum.

Stop Loss:

- Place a stop-loss order below the lowest point of the pattern or the low of the third candle to protect your position from unexpected reversals.

Take Profit:

- Set a profit target based on technical analysis, such as support and resistance levels, Fibonacci retracement levels, or trendlines.

- You can also use trailing stop orders to lock in profits as the trend continues.

Risk Management:

- Always use proper risk management techniques, such as position sizing and risk-reward ratios, to protect your trading capital.

Confirmation:

- Consider using other technical indicators or analysis methods to confirm the bullish signal from the Three White Soldiers pattern. These can include moving averages, RSI, MACD, or trendline analysis.

Timeframe:

- The effectiveness of the Three White Soldiers pattern may vary depending on the timeframe you’re trading. It’s essential to adapt your strategy to the timeframe you prefer.

Market Conditions:

- Be mindful of overall market conditions and news events that can affect your trade. Avoid trading the pattern in highly volatile or uncertain markets.

Remember that no trading strategy is foolproof, and there are no guarantees in the forex or stock markets. It’s essential to combine the Three White Soldiers pattern with proper risk management, trade discipline, and other forms of analysis to make informed trading decisions. Additionally, consider practicing your strategy on a demo account before trading with real capital to gain experience and confidence.