What is Three Black Crows pattern and How to trade Three Black Crows pattern in Chart pattern and with how to analysis Three Black Crows pattern in Chart pattern Technical analysis complete guide for students.

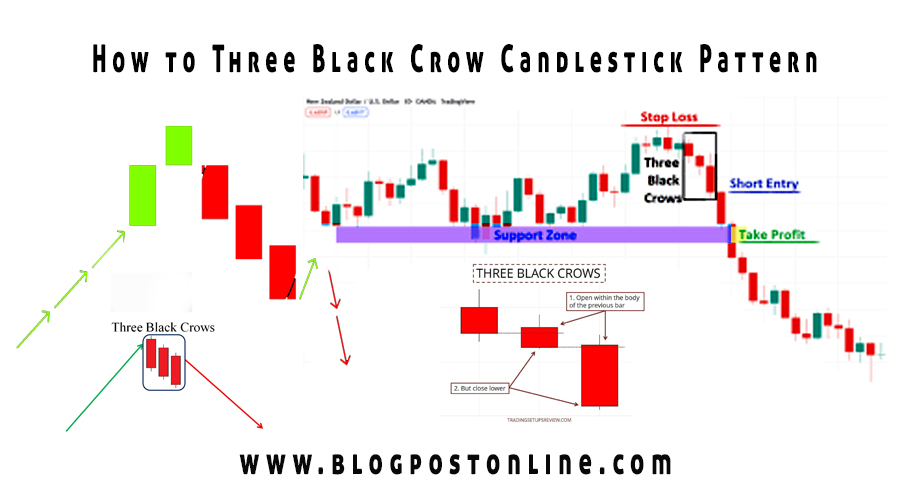

The Three Black Crows is a bearish candlestick pattern in technical analysis that is used to identify potential reversals in a price trend. This pattern consists of three consecutive long, bearish (black or red) candlesticks with small or no wicks that open within the previous candle’s real body and close near their low. It is considered a strong bearish reversal signal when it appears after an uptrend, suggesting a potential trend reversal to the downside.

Here’s how you can identify and potentially trade the Three Black Crows pattern in the forex and stock markets:

Identify an Uptrend: Look for a clear uptrend in the price chart, which is characterized by higher highs and higher lows. The Three Black Crows pattern is most meaningful when it appears after a sustained uptrend. Three Black Crows pattern full guide free Three Black Crows pattern in Hindi and English Course free.

What is Three White Shoulders Pattern Full Information hindi jankari and english?

Spot the Three Black Crows: The pattern consists of three consecutive bearish candles. Each candle should open within the previous candle’s real body and close near its low. The absence of upper wicks or very small upper wicks is a characteristic of this pattern.

Confirmation: To increase the reliability of the pattern, traders often look for additional confirmation signals. This can include indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) showing overbought conditions or bearish divergences and Candlestick ki phachan kaise kare Post Blog Online.

Entry Point: You can consider entering a short (sell) position after the third candle of the Three Black Crows pattern has closed. Some traders wait for a slight pullback in price before entering to get a better entry point.

Stop Loss: Place a stop-loss order above the high of the third bearish candlestick in the pattern. The help limits potential losse and if the trading goes against for you.

Take Profit: Determine own your profits target to based on your risk-rewards ratio. Some traders use technical analysis tools like support and resistance levels, Fibonacci retracements, or prior price swings to set their profit targets.

Risk Management: Always practice proper risk management by sizing your position and setting a maximum risk per trade that aligns with your overall trading strategy.

Monitoring: Keep an eye on your trade and be prepared to adjust your stop-loss or take-profit levels if necessary. Also, consider trailing your stop to lock in profits as the price moves in your favor.

It’s important to remember that no trading pattern or strategy is foolproof. The Three Black Crows pattern is just one tool among many used by technical analysts. It’s crucial to combine it with other forms of analysis and to use proper risk management to protect your capital. Additionally, consider the broader market context and other factors that may impact the security you’re trading.